Musicoin (MUSIC-USD) is a cryptocurrency and associated platform whose professed aim is to disintermediate the music streaming business. It plans to achieve this through a cryptocurrency to facilitate royalty and other payments, and via peer-to-peer content delivery. Its whitepaper is not short on hooks: it claims it will offer artists a minimum payment per stream of $0.02, over three times more than the maximum rate offered by Spotify, the next highest payer. It claims it will achieve this while not charging users any subscription fees or showing any advertisements.

Herein, evidence is laid out that its central claims are grossly unrealistic and that it is in no position to viably challenge incumbent streaming companies such as Spotify (SPOT). Regarding payments to artists, calculations below will demonstrate that no assumptions grounded in reality can lead to a scenario in which the economics of the system come close to adding up. Paying artists several times more than the competition per stream while relying on seigniorage as the platform's sole source of income is neither sustainable nor at all realistic. The calculations below estimate the royalty costs per user at between $107.5 and $504 per year, which do not seem viable for a platform with no direct revenue apart from seigniorage. Other aspects of the platform are also analyzed, including estimates of Musicoin��s current content delivery capabilities and minimum bandwidth costs per user (between $1.75 and $4.38 assuming bulk discounts).

I urge the Musicoin development team to lay out their calculations for how current PPP payment rates could be afforded in any realistic scenario. In the absence of further clarification from the team, I do not believe investors should enter or continue to hold positions in Musicoin's tokens.

The Ecosystem's Economics Don't Add UpMusicoin's whitepaper promises both that artists will receive significantly more while listeners don't have to pay subscriptions or listen to ads. It claims this is possible by removing the cut taken by intermediaries (labels and streaming companies). In practice, the numbers do not add up -- not even close.

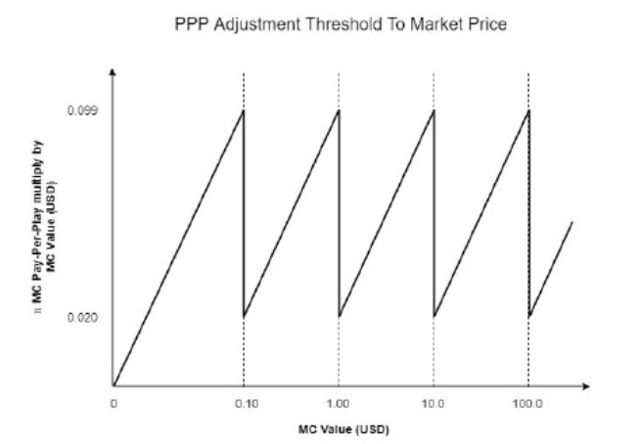

Musicoin promises artists a minimum $0.02 payment per play (PPP) - almost triple the rate that Spotify, the next highest paying platform, offers for streams from paying subscribers (non-paying Spotify users have even lower PPP rates). The payment is denominated in Musicoin, but the amount of coin offered is pegged within a band so that the value ranges from $0.02 to $0.099. In the absence of traditional revenue, Musicoin envisions these payments being funded by seigniorage on the platform's currency. Specifically, taking a 15.9% cut of the new coins issued to Musicoin miners. To assess the economics of Musicoin's endgame, let's assume a blue sky scenario where Musicoin has gained 70 million users (roughly the same as Spotify's subscribing users today) and that they have similar listening habits. According to SPOT, the average paying user listens to 50 minutes of music a day. If the average track is slightly over 3 minutes, this gives 15 plays per day per user. This would translate to Musicoin's platform having to pay artists $109.5 in PPP fees per user per year, or a whopping $7.6 billion annual total assuming 70 million users.

| Minimum | Maximum | ||

| (A) | Pay Per Play fee denominated in USD | $0.02 | $0.099 |

| (B) | Tracks streamed per day | 15 | 15 |

| A*B = (C) | PPP costs per day per user | $0.3 | $1.48 |

| C*365 = (D) | PPP costs per year per user | $109.5 | $540.2 |

Source: Musicoin's whitepaper.

If we instead used the highest possible PPP fee -- $0.099 -- the PPP costs per user would be $540 or $37.8 billion total.

Judging from the above graph, the only apparent way Musicoin allows for the PPP rate to drop below $0.02 is if the value of the token crashed to close to zero.

Remember that these 70 million users are no longer paying any membership or per stream fee, or even generating advertising revenue; this $7.6 billion needs to be financed entirely by the 15.9% cut taken from newly mined Musicoins. This is where the numbers move from hard-to-believe to outright incredibility.

Seigniorage is the "tax" on existing holders of a currency by printing more of it. Governments achieve this by printing more money, which would tax the citizenry indirectly through faster inflation. Cryptocurrencies which rely on a mining model -- like Musicoin -- achieve this by issuing new coins to reward miners. This issuance of new coin puts downward pressure on the currency, and the pressure is larger the more coins are issued relative to existing supply.

Let's assume that our blue sky scenario takes place 5 years from now, at which point the supply of Musicoins will be growing by 15% per year according to calculations based on figures in the whitepaper (the development team has leeway to increase this, as noted in the whitepaper). Given that we would need $7.6bn to compensate artists, and that we're only taking a 15.9% cut of any new coins, the market cap of Musicoin would need to be $319 billion (7.6bn divided by 0.159 divided by 0.15) for the 'tax' on new coins to be able to cover PPP costs to artists. Bitcoin's market cap is currently 'only' $158bn, for reference. If that didn't sound incredible, recall that a $0.02 PPP rate is only the minimum - Musicoin's formula for calculating payments implies that the rate actually yo-yos between $0.02 and $0.099 depending on the coin's current price. If we took the highest possible PPP value of $0.099, the required market cap to afford PPP costs would be a ludicrous $1.6 trillion.

The counter point is that if Musicoin were indeed used by 70 million people, then maybe such a gigantic market cap isn't so hard to imagine. Bitcoin probably has somewhere between 13 and 30 million users, so perhaps a user base of 70 million that could lead to a valuation twice as large.

But the above reasoning doesn't stand up to scrutiny. Assuming all 70 million users of the music streaming service used the coin, then each would need to hold an average of $5000 worth of coin to sustain the $326 billion market cap. This is even harder to imagine once you take into account that Musicoin aren't actually required to listen to music on the platform, only to "tip" artists you like (optional) or buy add-on products that Musicoin envisions offering in the future (like concert tickets). I repeat: there is currently no impetus for listeners to buy coin if they don't feel like tipping or using add-on services (but they will still, of course, cost the platform at least $0.02 per stream). So not only is it unrealistic to assume that the average user of a music streaming service will hold at least $5000 worth of value on their account, but the actual number of users who own any meaningful amount of Musicoin in that scenario will probably be far less than 70 million -- meaning that each user who does hold coin will need to further compensate for those who don't. And recall that we're still using the minimum PPP rate possible of $0.02.

One counterargument would be that since artists are paid in Musicoin, rather than directly in cash, such costs are not "real" per se. This argument does not stand up to reality. Artists must be allowed to sell the coins they receive for fiat currency at the going market rate, otherwise the platform's claim to pay them more than competitors is erroneous. When artists "cash out", the cash they receive for their tokens will inherently need to be provided by users of the platform "cashing in" to buy more tokens. This means that the average user would need to be purchase a minimum of $109.5 worth of tokens per year for artists to be able to cash out.

When presented with calculations on minimum PPP costs per user being above $100, an individual listed as a Musicoin ambassador responded by referring to the platform's whitepaper -- with no further clarification for how such costs could be afforded.

The platform's whitepaper is adamant that artists be paid "a fixed rate that is fair, uninfluenced by market forces and higher than that of any other competing streaming platforms". The above figures make clear that keeping all sides of this commitment is completely untenable in the long run. The only evident path to a sustainable model would be to renege on the untenable commitment of a minimum of $0.02 PPP for artists, but this would strike to the core of Musicoin's main selling point.

It is unclear whether the platform can even reach that pointWhile Musicoin's economics in the mass-adoption scenario look shaky, it is unclear whether it has a path to reach this point. I will ignore most of the obvious difficulties that Musicoin will face in seeking to take on both the labels and better-funded platforms with first-mover advantage (Spotify, among others). There are two more pressing issues: the technical aspects of how content will be delivered to users, and how the platform will overcome disadvantages in its music curation and discovery algorithms to facilitate matching to between users and independent artists.

The viability of the decentralized content distribution system

"Moreover, instead of using centralized servers, Musicoin is storing and distributing its content through a decentralized P2P file distribution system known as Inter-Planetary File System (IPFS). Smart contracts and content files on the blockchain are encrypted before and decrypted after its transmission to prevent unauthorized access and malicious activity. " - Musicoin's Whitepaper

Musicoin plans to stream music with a entirely peer-to-peer content distribution system. Unlike traditional decentralized "torrenting" of music, in which a user only has to download a piece of content once and then stores it on their own device for future use, streaming is inherently more bandwidth intensive since content has to be transferred each time a user listens to it. Musicoin plans for content to be stored and distributed by "miners", who the platform plans to mostly cease compensating for true mining of coin and instead compensate mainly for distributing content. This plan hasn't yet been implemented, however, and in the meantime Musicoin's distribution system is actually still centralized using paid servers.

I tried to test two things: the viability of the P2P scenario, and the costs to Musicoin for its current centralized setup (which will also presumably be the backup option if the P2P plan doesn't prove viable). There are two main concerns: load times (how long before a track first begins playing) and total bandwidth capacity.

A test of Musicoin's streaming platform (available at musicoin.org) revealed songs would begin playing on average 5.5 seconds after clicking play. The test was run from Western Europe. This is slower than the competition, but it is likely faster for North American users (see below for why), and if P2P distribution were implemented successfully I don't see a reason why latency couldn't be brought down to acceptable levels. This aspect thus seems reasonable.

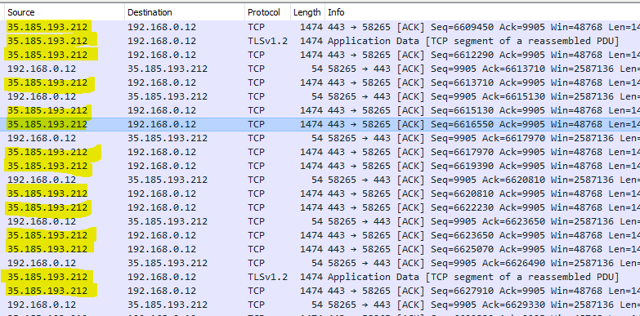

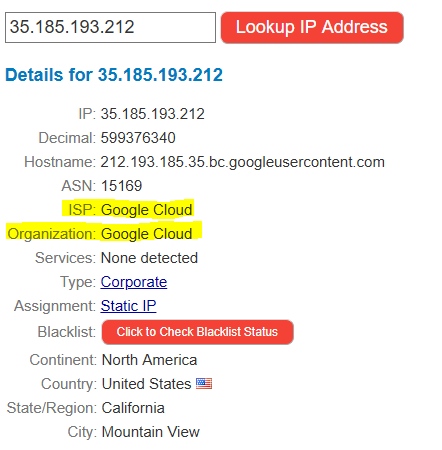

More concerning, rather, is total bandwidth capacity and associated costs. Which servers Musicoin is currently paying for is not publicly disclosed, but steps were taken to identify them so that their operating costs could be estimated. Using a packet analyzer while streaming from the platform showed that content was being served from a single IP address:

An IP lookup of the address revealed that it was situated in Mountain View, California, and belongs to Google Cloud - the company's paid cloud computing service.

Given that this test was run from Europe and yet content was still being served by a server in Mountain View (Google Cloud has European datacenters), it seems possible that Musicoin's content delivery is centralized at only a single datacenter in California (explaining lengthier start delays in Europe).

Calculations for Musicoin's current likely bandwidth costs were made based on publicly available data from Google Cloud, with typical usage assumptions based on data from Spotify. For file size (linked to quality), it is noted in Musicoin's whitepaper that users "will be able to download audiophile quality songs" (musicoin.org/for-listeners). "Audiophile" quality was assumed to mean lossless, which would be roughly 10MB per track using the estimations below. Regular quality content costs are also calculated below.

| Regular Quality | Audiophile Quality | ||

| (A) | Tracks streamed per day per user | 15 | 15 |

| (B) | File size per track | 4MB | 10MB |

| (C) = A*B*365 | Data usage per year per user | 21,900MB | 54,750MB |

| (D) | Google Cloud's lowest bandwidth usage rate per GB (or 1000MB) | $0.08 | 0.08 |

| (E) = C*D/1000 | Annual network transfer cost per user. | $1.752 | $4.38 |

Notes: (1) The above table uses Google Cloud's lowest network usage rate, which kicks in after 10TB of monthly usage. Before that, the rate is higher: between $0.11 and 0.12 (2) These figures only take into account Google Cloud's network transfer costs, and ignore other costs that would be incurred for storing and serving files.

Depending on whether audiophile quality is offered exclusively or not, the above assumptions give minimum annual data costs of $1.75 or $4.38 per user. It is not clear how this is currently being paid for.

The P2P content delivery system, at first glance, seems that it would remove these costs. Musicoin would seemingly be offloading the costs of distributing content to peers in the IFPS swarm. But the peers are not the users of the platform per se, rather they are "miners" who will provide content in exchange for a roughly 80% cut of seigniorage (i.e. 80% of newly issued coins will go to miners). Using other coins which rely on a mining model as case studies, it seems likely that most of the work of sharing will eventually be performed by a relatively small group of "whales" who do so for profit, meaning their revenue from seigniorage must outstrip their bandwidth costs. Given that the bandwidth costs calculated for Google Cloud's above are minimums given to bulk-users (and exclude all other costs), it may be safe to assume that $0.08 per GB will also be the floor for miners' costs. And as previously argued, it is again logical that if miners are selling their newly-issued tokens for cash to cover bills, then the costs borne by the miners are still effectively being paid for by users who are buying tokens.

While $4.38 in bandwidth costs per user may seem paltry compared to the much larger PPP costs per user calculated previously, I view this aspect as significant for several reasons. Firstly, Musicoin has the option of reneging on its commitment to $0.02 for artists -- but Musicoin or its miners cannot wish away the floor on bandwidth costs. Secondly, Musicoin proponents may argue that the PPP costs per user are not 'real' if the artists don't seek to cash out with their coins. This argument is flimsy to begin with: if the platform only works so long as artists don't cash out the tokens they are "paid" with, then they are not really being paid at all. But it is a non-starter in the case of miners: they incur operating costs by distributing content, and will have to regularly cash out their seigniorage rewards to cover them.

Final ThoughtsNot only do the numbers not add up for Musicoin's blue-sky scenario, but it is doubtful that there exists a realistic path to get there. The costs per user cannot be covered in any realistic scenario. Arguing that the costs aren't "real" because they come from seigniorage rather than being directly applied to users is also incorrect: if artists are really being paid, then they must have the option to cash out. That means cashing out $107.5 per user (at a minimum) per year, cash which will need to be coming from someone.

But there is a conceptual flaw to the entire premise of Musicoin: its stated raison d'锚tre is to disintermediate music streaming, and yet of the platform's main source of income - seigniorage - only 15.9% actually goes to the pool that pays artists. The rest is paid out to the miners for distributing content and to the platform. While a large share of revenue going to labels may seem unfair, at least they provide marketing and promotional services to artists. It seems far more unjust that 80% of income should go to entities whose only service is hosting and sharing the track. The idea of a for-profit company agreeing to a data hosting solution that would cost 80% of revenues is ludicrous.

In a twist ripped directly from Animal Farm, Musicoin seemingly seeks to replace the cut from the labels and streaming platforms with an 80% cut from middlemen of its own.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment